ACM Commentary 1Q 2017

MARKET SUMMARY

In the first quarter of 2017 the market continued to reward investors. The bull market, now stretches into its 9-year bull run, with the S&P achieving a 6% gain in the quarter. In a reflection of an improving economy growth stocks considerably outperformed value thus far into 2017, with cyclical sectors, consumer discretionary, and information technology leading the way.

Further, Investors appear to have recognized an improving economic outlook beyond US shores, driving international stocks higher. Emerging markets led the charge with gains of over 11% in the first quarter thanks in part to a weaker US dollar.

The chart below displays the recent and historical performance of equity market indices around the globe.

The data shows healthy gains in the US Equity markets, across traditional market capitalization and even investment approaches, with both growth and value strategies participating in a similar fashion, especially over the past 5 years. Clearly, patient investors in the US markets who remained in the fold in recent years have been handsomely rewarded.

While the international and emerging market segments have struggled to keep up, leading some to believe that there may be some opportunity there.

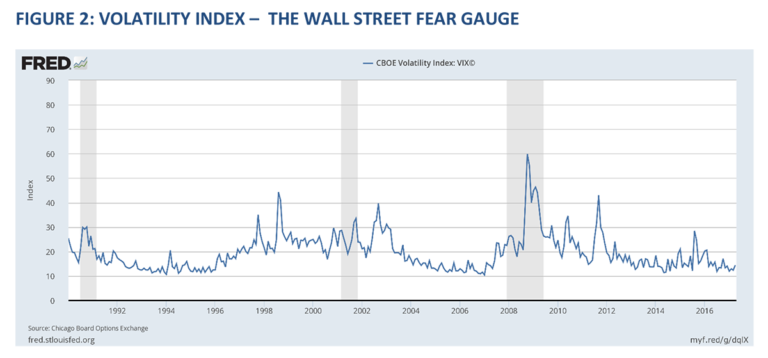

Not surprisingly, in response to the market’s recent run, investors appear comfortably numb, with the CBOE Volatility Index (VIX), recently achieving a remarkable 23 year low of 9.8 in just the past few days. When the VIX hits 40 points or higher it signals considerable fear in the market, while a figure of 10 or lower is a sign of significant complacency.

We find the market’s relative calm given expanded valuations, historically low rates, and considerable geopolitical and frankly even “tweet risk” somewhat curious, but not unprecedented. In a perhaps ominous sign to some, the last time the VIX reached these levels was in the months leading up to the housing crisis and subsequent great recession.

Though at Alamar we remain constructive on the state of the overall U.S. economy and markets, we believe it is important to remember our history. By no means are we predicting a market crash, however we do acknowledge that the future is uncertain, and whether we like it or not recessions are inevitable. Or as Meg McConnell of the New York Fed has said, “We spend a lot of time looking for systemic risk; in truth, in the end however, it tends to find us”.

THOUGHTS ON MARKET RISK

Clearly, valuations are not nearly as stretched as they were heading into the dot com crisis, and it is unlikely that residential housing will act as the culprit in the next major crisis as it did in 2007-08. What will be unique about the next correction though, is the extent to which investors are exposed to passive index funds, which assures them of capturing virtually all the market’s downside. Additionally, there is a tendency for many investors to chase returns in the later stages of a bull market, increasing their exposure to risk assets beyond their true comfort level at exactly the wrong time. These two phenomena combined, an increasing exposure to passive index funds, and expanding allocations to risk assets reminds us of a quote often attributed to boxing great Mike Tyson –

“Everyone has a plan until they get punched”

Studies of human behavior repeatedly point to the inability of investors to stay the course through tough times. Unfortunately, no one can duck all the punches that the market will throw their way. Though, ironically, in times of calm and particularly euphoria, we tend to think that we can, which can spell disaster for our investments.

There is a fair amount of evidence to support the notion that investors seem ill equipped to take a market punch. One way to see this is by comparing the performance of mutual funds against the actual returns experienced by their underlying investors. For instance, in order for an actual investor to have secured the 7.5% return provided by the S&P this past 10 years, they would have had to have stuck through an especially difficult round in 2008. However, because of their tendency to buy-high and sell low many investors end up earning a return much lower than the funds they choose to invest in. Mutual fund research company Morningstar tracks this information by measuring the impact of cash inflows and outflows from purchases and sales and the growth in a fund assets. By calculating when investors are putting money in and taking money out of a fund, they are then able to determine a return calculation on the experience of an “average fund investor”. The historical results of one such fund, the Vanguard 500 index mutual fund (VFINX) is shown in Figure 4.

As you can see, mutual fund investors have not struggled to stick with their position in VFINX the past several years, and have earned a return for themselves very much in line with the fund itself. However, when looking at their performance over 10-years, which incorporates a tough 2008, we see a much different story. During the period the fund’s investors secured just a 3.8% annualized return, underperforming the fund itself by a considerable margin (-3.6%)! Clearly, many investors were scared out of their investment and sold at or near the market’s low.

Compare this to the experience of investors in an active fund run by First Pacific Advisors, a company and management team that we admire. The Crescent Fund is conservatively managed and strives to provide equity like returns with less volatility than the market. The fund has lagged the overall market on a 1,3 and 5-year basis, while providing attractive returns over the longer haul, especially for their fund investors.

In fact, over 10 years the fund’s investors have managed to outperform the fund itself 7.3% vs 7.0%, which indicates investors buying at the low as opposed to selling. We believe that this is in large part due to the fund’s capital preservation approach, which resulted in considerable out performance in 2008 down just 20.6% (gulp), leaving investors more inclined to stick with and even add to their positions. They say there is no such thing as a free lunch, but you might have a tough time convincing long term average investors in the Crescent Fund. Through their positioning, and due to a smoother ride, they have been able to secure a return almost twice that of their peers in the Vanguard 500 Index mutual fund, and they have done so taking considerably less risk in the process! Given investors current propensity to utilize index funds in the management of their portfolios, it will be interesting to see whether this pattern doesn’t perpetuate itself in the future.

CONCLUDING THOUGHTS

At Alamar, we believe it is critical to understand what we own, why we own it, and what it’s worth in the management of our portfolios. This approach helps to remove some of the emotion associated with investing. Further, it is much more difficult to part with assets that are dear to us, when we know that they are selling at fire sale prices.

For our part, though we continue to be constructive on the market and at or near fully invested in our equity portfolios, we remain vigilant. We have seen our equity strategy compound at 13.6% net of fees since our inception in 2010. This result is slightly better than the S&P 500 over the same period, and with less risk. It is important to point out that it also exceeds our long-term expectations.

Though we do not believe that we can “time” the market, we have shown a willingness to raise cash in uncertain environments where we struggle to find investment ideas. Further, we are comforted by the high quality individual stocks that we do own, and are hopeful that their attributes and management teams will successfully steer us through inevitable future corrections. Additionally, through our Alamar Wealth Management offering, we can further diversify portfolios to meet our clients’ specific objectives, while recognizing their unique risk profiles.

Fortunately, the trick to successful investing is not avoiding being punched altogether, but rather training and positioning ourselves to survive a punch or two, and staying the course. Portfolios that are thoughtfully constructed and truthfully reflect the risk return profiles of their owners have a much higher likelihood of helping to accomplish this goal.

If you would like to meet with us to discuss your portfolio, or your overall investment positioning, please don’t hesitate to give us a call.

Thank you for your continued interest and consideration –

Sincerely,

John Murphy, CFA

DISCLOSURES

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss. Net of fee performance is calculated using the highest fee. The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The S&P 500 Index, which is a market-capitalization weighted index containing the 500 most widely held companies chosen with respect to market size, liquidity, and industry.

This publication is made available for informational purposes only and should not be used for any other purpose. This report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.