ACM Commentary 4Q 2021

From all of us at Alamar Capital, we wish you a happy and safe new year! Despite the prevalence of COVID throughout last year and the resurgence of the latest variant Omicron, corporate profits surged far beyond expectations. At this time last year consensus forecasts for S&P 500 operating earnings for 2021 were expected to be $165. Instead, actual earnings for 2021 are now expected to be $202, a full 22% above expectations!

After a great 2020, our equity portfolio returns moderated last year. Alamar’s equity portfolio was up 15.1% while the S&P500 was up 28.7%. Some of our large, long-term investments, after doing extremely well in 2020, did not repeat the performance in 2021. Since starting in 2010 our equity portfolio is up 15.8% annualized while the S&P500 grew 15.2%. Once again, the S&P500 was led by the large, well-known stocks (FAMAA plus Tesla and Nvidia). As discussed in prior writings, we don’t own any of these stocks. We expect the law of large numbers to eventually catch up with these stocks, though our expectation has yet to come to fruition.

We expected the economy to boom in 2021 and that is how it played out. We anticipate the economy to once again grow this year, but not at the torrid pace of last year. Corporate cash flows are at all-time highs, margins have never been this strong and tax rates so low. As a result, we expect a renaissance in business capital spending and share buybacks. We will also provide our updated view on the latest COVID surge.

CORPORATE PROFITABILITY

Regardless of the disruptions caused by COVID, last year was remarkable for corporate profitability. Reading the headlines of rapid inflation, wage increases, supply chain disruptions and shortages of everything, one would expect a drop in profit margins, if not profit levels. However, that is not how it played out when you analyze corporate financial statements. In fact, 2021 was one for the record books as far as profit margins were concerned.

Figure 1 plots corporate free cash flow as a percent of US GDP since 1950. We define free cash flow as operating cash flow minus capital expenditures. The average free cash flow margin over the last 70 years has been roughly 2%. However, last year the margin was over 6%, a feat never before seen. This was achieved despite companies not scrimping on capital expenditures (capex). Capital spending was 9.4% of GDP last year, right in line with long-term averages. Because profitability shot through the roof, cash flows followed.

The question we ponder … is this a fluke or the start of a trend? Look at Figure 1 closely and you’ll notice free cash flow rose above the 2% average in 2003 and has never dropped below since. One reason, we speculate, is the changing mix of US corporate profits. The economy now is very different from the 1950s or even 20 years ago. Overall profits now are driven by extremely profitable companies in the software and semiconductor sectors. Looking at long-term averages will obfuscate the remarkable shift taking place. As a result, expecting margins to revert back to mean will be an exercise in futility. As an example, one of our investments, a large software company, has improved its operating margins from 35% in 2010 to over 45% in 2021. As software eats the world, overall margins arithmetically improve.

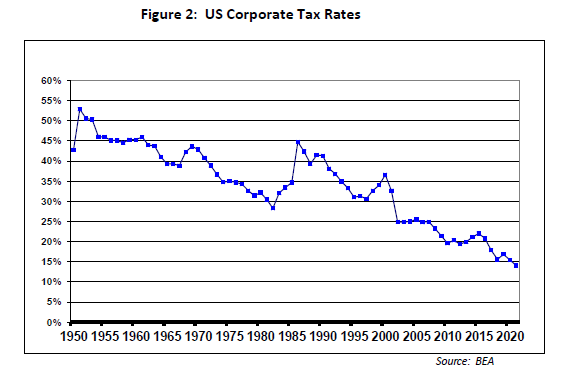

Another long-term trend is a decline in corporate tax rates. Figure 2 depicts overall tax rates for US companies since 1950. Tax rates have been on a long-term decline since 1986, through both Democratic and Republican administrations. Overall rates are now 15% or less, very competitive with the rest of the world. Note we are showing what companies actually pay in taxes, not what they report in their financial statements.

A record-high free cash flow margin, combined with a record low tax rate should, in our view, spur a capital spending boom. COVID has taught us the importance of short, predictable and nearby supply chains. Having a factory in China to supply essential goods such as masks, ventilators and cars is a recipe for lost sales and customer frustration. A shutdown of an entire Chinese city for weeks due to a single case of COVID will quickly ripple across the entire world if essential supplies are manufactured in or transit through that city. The port congestion in Los Angeles and Long Beach, now over 6 months and counting, is a strong signal to companies to revisit and rearchitect their supply chains. Having factories in North America could have prevented this mess.

Indeed, we are starting to see initial signs of this shift. Ford and SK announced an $11.4 Billion investment in a new factory complex to manufacture cars and batteries. GM, Toyota, Volkswagen and Rivian have all announced plans for new factories as well. In semiconductors, Intel has begun work on 2 new fabrication plants in Arizona, Samsung will start a new plant in Texas, TSMC in Arizona and Texas Instruments is building 2 new plants after completing another this year.

COVID UPDATE

Unfortunately, we are still dealing with the COVID virus, more than 2 years after its emergence. We seem to be in a battle with the virus as it adapts to the latest vaccines deployed to eliminate it. The latest variant, Omicron, has over 30 mutations on its spike protein, which it uses to enter human cells rapidly. As a result, this variant is far more transmissible than the prior variant, Delta. The good news, however, is the infection seems far less severe compared to prior variants. The table below shows some statistics from a large hospital system (> 10,000 beds) in South Africa where omicron was first identified. South Africa has experienced 3 COVID-19 waves: (1) June to August 2020 (ancestral variant), (2) November 2020 to January 2021 (Beta), and (3) May to September 2021 (Delta). Cases again started to increase beginning November 15, 2021, coinciding with the identification of Omicron; as of December 7, the date this study was completed, 26% test positivity rates were observed.

As can be seen from the South African data, severity of Omicron is substantially less compared to Delta – 18% needed oxygen compared to 74%, 2% on ventilator compared to 12% and far fewer deaths. One important caveat is that the population entering the hospital in this wave was younger compared to prior waves (mid 30s versus mid 50s). We are hopeful that this pandemic is slowly burning itself out as both humans and the virus adapts to changed circumstances so that eventually it becomes an endemic disease, similar to past viral infections.

OUTLOOK FOR 2022

We expect the economy to grow well again this year. Tailwinds include:

Low-interest rates across the yield curve facilitates investment boom

Large fiscal deficits continue as the 2021 Infrastructure Act gets implemented

Very strong US consumer with low unemployment, strong wage growth and high savings

Record corporate free cash flow triggers large stock buybacks, acquisitions and investments

However, there are some headwinds developing which we are monitoring and have spoken about in prior notes:

Inflation is picking up, triggering a Fed response to raise rates

US dollar is stronger vis-à-vis the Euro and the Yen which may slow exports

A resurgence of COVID variants reinfecting vaccinated individuals disrupting production

Labor & supply shortages in select industries

We expect the market to be more volatile this year as investors adjust portfolios in response to Fed rate increases. Two of our investments were acquired last year. We expect more mergers & acquisitions this year driven by easy financing and record cash flows. Since we invest in growing, well managed companies trading at reasonable valuations, some of our holdings may continue to receive bids in this environment. Two of our investments have recently attracted large activist shareholders agitating for change.

CONCLUDING THOUGHTS

The characteristics of business are changing dramatically as we speak. The penetration of software, automation, machine learning (ML) and artificial intelligence (AI) is dramatically reshaping the economics of business. Companies are getting far more efficient and their competitive advantage is proving more durable. As a consequence, profit margins and free cash flows are at record levels. Coupled with low-interest rates and corporate taxation, the stage is set for a robust growth environment.

We prospect in companies that do not typically garner the headlines or are the topic of cocktail conversations. Apple Inc, for instance, is valued at almost $3 Trillion and represents roughly 7% of the S&P 500. Revenues are expected to grow 5% this year and next. Can this stock double over the next 5 years? That would be a stupendous achievement, something we are very doubtful could be accomplished. Instead, we invest in companies that are valued in the billions, where the hurdle to double in 5 years is much lower and growth prospects stronger.

Thank you for your continued trust and confidence in Alamar Capital Management.

Sincerely,

George Tharakan, CFA

DISCLOSURES

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss.

This publication is made available for informational purposes only and should not be used for any other purpose. In particular, this report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.