ACM Commentary 4Q 2021

From all of us at Alamar Capital, we wish you a happy and safe new year! Despite the prevalence of COVID throughout last year and the resurgence of the latest variant Omicron, corporate profits surged far beyond expectations. At this time last year consensus forecasts for S&P 500 operating earnings for 2021 were expected to be $165. Instead, actual earnings for 2021 are now expected to be $202, a full 22% above expectations!

After a great 2020, our equity portfolio returns moderated last year. Alamar’s equity portfolio was up 15.1% while the S&P500 was up 28.7%. Some of our large, long-term investments, after doing extremely well in 2020, did not repeat the performance in 2021. Since starting in 2010 our equity portfolio is up 15.8% annualized while the S&P500 grew 15.2%. Once again, the S&P500 was led by the large, well-known stocks (FAMAA plus Tesla and Nvidia). As discussed in prior writings, we don’t own any of these stocks. We expect the law of large numbers to eventually catch up with these stocks, though our expectation has yet to come to fruition.

We expected the economy to boom in 2021 and that is how it played out. We anticipate the economy to once again grow this year, but not at the torrid pace of last year. Corporate cash flows are at all-time highs, margins have never been this strong and tax rates so low. As a result, we expect a renaissance in business capital spending and share buybacks. We will also provide our updated view on the latest COVID surge.

CORPORATE PROFITABILITY

Regardless of the disruptions caused by COVID, last year was remarkable for corporate profitability. Reading the headlines of rapid inflation, wage increases, supply chain disruptions and shortages of everything, one would expect a drop in profit margins, if not profit levels. However, that is not how it played out when you analyze corporate financial statements. In fact, 2021 was one for the record books as far as profit margins were concerned.

Figure 1 plots corporate free cash flow as a percent of US GDP since 1950. We define free cash flow as operating cash flow minus capital expenditures. The average free cash flow margin over the last 70 years has been roughly 2%. However, last year the margin was over 6%, a feat never before seen. This was achieved despite companies not scrimping on capital expenditures (capex). Capital spending was 9.4% of GDP last year, right in line with long-term averages. Because profitability shot through the roof, cash flows followed.

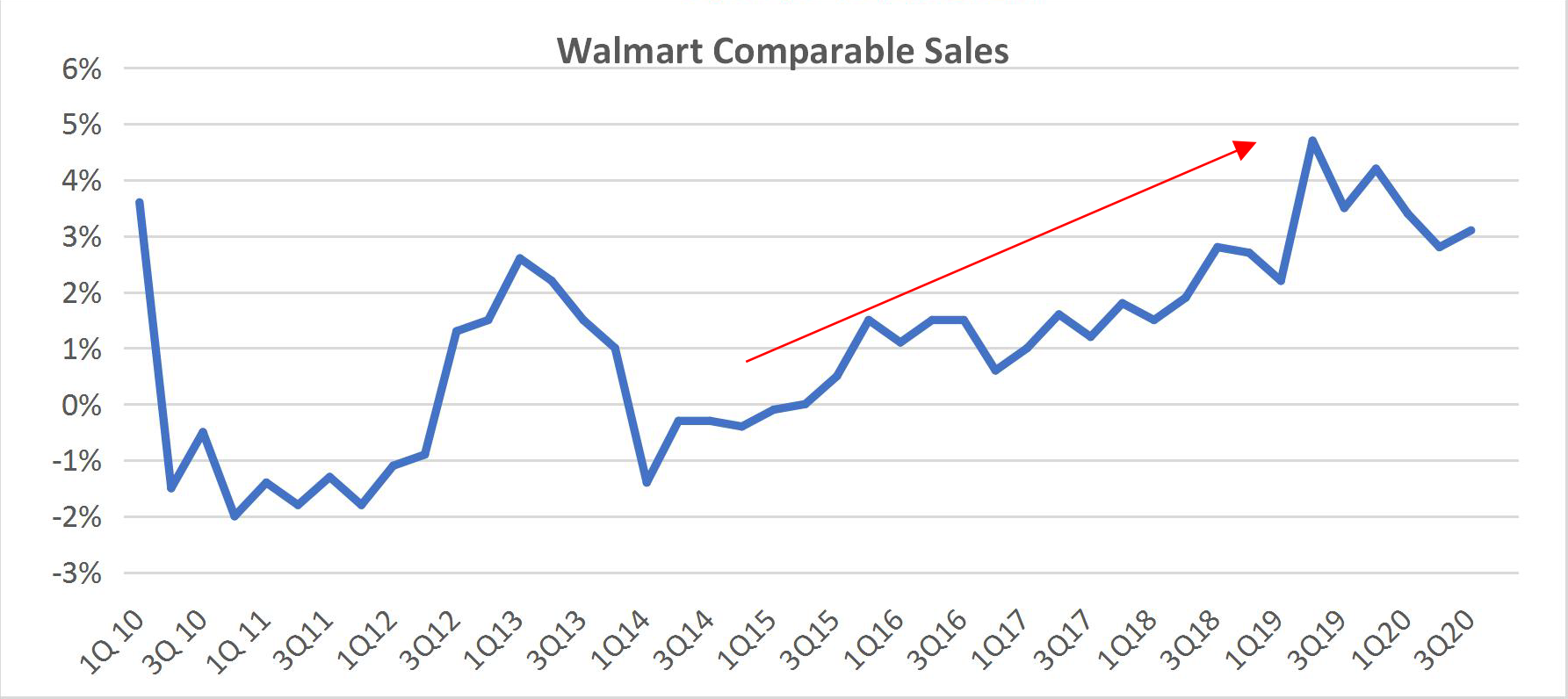

The question we ponder … is this a fluke or the start of a trend? Look at Figure 1 closely and you’ll notice free cash flow rose above the 2% average in 2003 and has never dropped below since. One reason, we speculate, is the changing mix of US corporate profits. The economy now is very different from the 1950s or even 20 years ago. Overall profits now are driven by extremely profitable companies in the software and semiconductor sectors. Looking at long-term averages will obfuscate the remarkable shift taking place. As a result, expecting margins to revert back to mean will be an exercise in futility. As an example, one of our investments, a large software company, has improved its operating margins from 35% in 2010 to over 45% in 2021. As software eats the world, overall margins arithmetically improve.

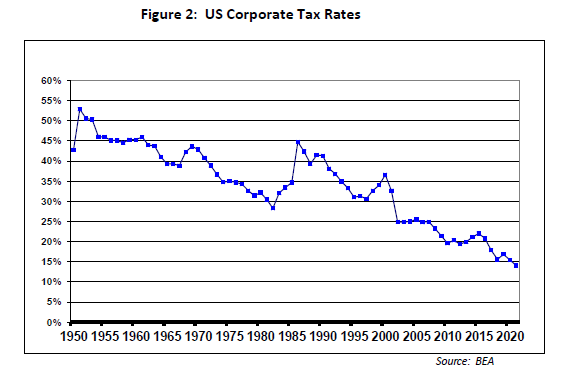

Another long-term trend is a decline in corporate tax rates. Figure 2 depicts overall tax rates for US companies since 1950. Tax rates have been on a long-term decline since 1986, through both Democratic and Republican administrations. Overall rates are now 15% or less, very competitive with the rest of the world. Note we are showing what companies actually pay in taxes, not what they report in their financial statements.

A record-high free cash flow margin, combined with a record low tax rate should, in our view, spur a capital spending boom. COVID has taught us the importance of short, predictable and nearby supply chains. Having a factory in China to supply essential goods such as masks, ventilators and cars is a recipe for lost sales and customer frustration. A shutdown of an entire Chinese city for weeks due to a single case of COVID will quickly ripple across the entire world if essential supplies are manufactured in or transit through that city. The port congestion in Los Angeles and Long Beach, now over 6 months and counting, is a strong signal to companies to revisit and rearchitect their supply chains. Having factories in North America could have prevented this mess.

Indeed, we are starting to see initial signs of this shift. Ford and SK announced an $11.4 Billion investment in a new factory complex to manufacture cars and batteries. GM, Toyota, Volkswagen and Rivian have all announced plans for new factories as well. In semiconductors, Intel has begun work on 2 new fabrication plants in Arizona, Samsung will start a new plant in Texas, TSMC in Arizona and Texas Instruments is building 2 new plants after completing another this year.

COVID UPDATE

Unfortunately, we are still dealing with the COVID virus, more than 2 years after its emergence. We seem to be in a battle with the virus as it adapts to the latest vaccines deployed to eliminate it. The latest variant, Omicron, has over 30 mutations on its spike protein, which it uses to enter human cells rapidly. As a result, this variant is far more transmissible than the prior variant, Delta. The good news, however, is the infection seems far less severe compared to prior variants. The table below shows some statistics from a large hospital system (> 10,000 beds) in South Africa where omicron was first identified. South Africa has experienced 3 COVID-19 waves: (1) June to August 2020 (ancestral variant), (2) November 2020 to January 2021 (Beta), and (3) May to September 2021 (Delta). Cases again started to increase beginning November 15, 2021, coinciding with the identification of Omicron; as of December 7, the date this study was completed, 26% test positivity rates were observed.

As can be seen from the South African data, severity of Omicron is substantially less compared to Delta – 18% needed oxygen compared to 74%, 2% on ventilator compared to 12% and far fewer deaths. One important caveat is that the population entering the hospital in this wave was younger compared to prior waves (mid 30s versus mid 50s). We are hopeful that this pandemic is slowly burning itself out as both humans and the virus adapts to changed circumstances so that eventually it becomes an endemic disease, similar to past viral infections.

OUTLOOK FOR 2022

We expect the economy to grow well again this year. Tailwinds include:

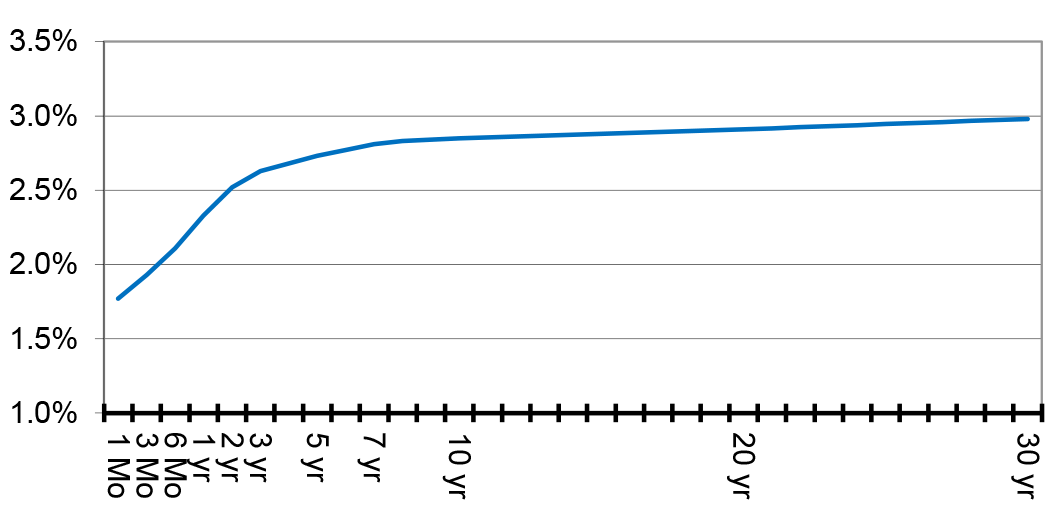

Low-interest rates across the yield curve facilitates investment boom

Large fiscal deficits continue as the 2021 Infrastructure Act gets implemented

Very strong US consumer with low unemployment, strong wage growth and high savings

Record corporate free cash flow triggers large stock buybacks, acquisitions and investments

However, there are some headwinds developing which we are monitoring and have spoken about in prior notes:

Inflation is picking up, triggering a Fed response to raise rates

US dollar is stronger vis-à-vis the Euro and the Yen which may slow exports

A resurgence of COVID variants reinfecting vaccinated individuals disrupting production

Labor & supply shortages in select industries

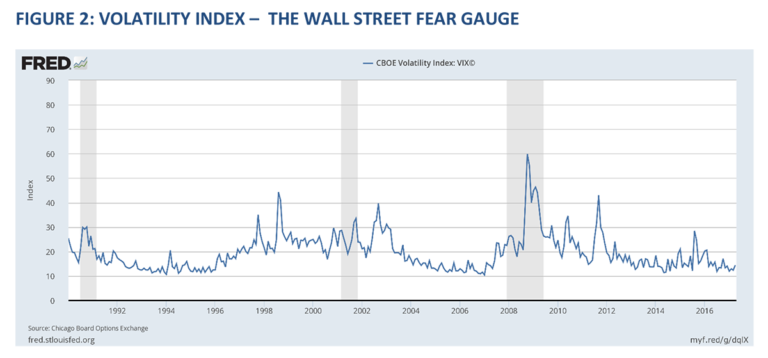

We expect the market to be more volatile this year as investors adjust portfolios in response to Fed rate increases. Two of our investments were acquired last year. We expect more mergers & acquisitions this year driven by easy financing and record cash flows. Since we invest in growing, well managed companies trading at reasonable valuations, some of our holdings may continue to receive bids in this environment. Two of our investments have recently attracted large activist shareholders agitating for change.

CONCLUDING THOUGHTS

The characteristics of business are changing dramatically as we speak. The penetration of software, automation, machine learning (ML) and artificial intelligence (AI) is dramatically reshaping the economics of business. Companies are getting far more efficient and their competitive advantage is proving more durable. As a consequence, profit margins and free cash flows are at record levels. Coupled with low-interest rates and corporate taxation, the stage is set for a robust growth environment.

We prospect in companies that do not typically garner the headlines or are the topic of cocktail conversations. Apple Inc, for instance, is valued at almost $3 Trillion and represents roughly 7% of the S&P 500. Revenues are expected to grow 5% this year and next. Can this stock double over the next 5 years? That would be a stupendous achievement, something we are very doubtful could be accomplished. Instead, we invest in companies that are valued in the billions, where the hurdle to double in 5 years is much lower and growth prospects stronger.

Thank you for your continued trust and confidence in Alamar Capital Management.

Sincerely,

George Tharakan, CFA

DISCLOSURES

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss.

This publication is made available for informational purposes only and should not be used for any other purpose. In particular, this report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

ACM Commentary 3Q 2021

The third quarter of 2021 started very strong as the economy continued to work its way through the COVID pandemic. Corporate earnings continued their strong trajectory and consumers remained active. Equities across most sectors and capitalizations experienced moderate increases in July and August however, those gains were mostly erased as we moved through September. Positive market sentiment was quickly altered as news of real estate problems in China, a less than certain outlook for the Democratic driven infrastructure bill, rising inflation, and a resurgence in the delta variant all created a level of uncertainty that had not been seen for several quarters. For their part, markets corrected 5% as the uncertainty gained traction, and concerns that the economy was overheating were quickly replaced with deteriorating growth fears.

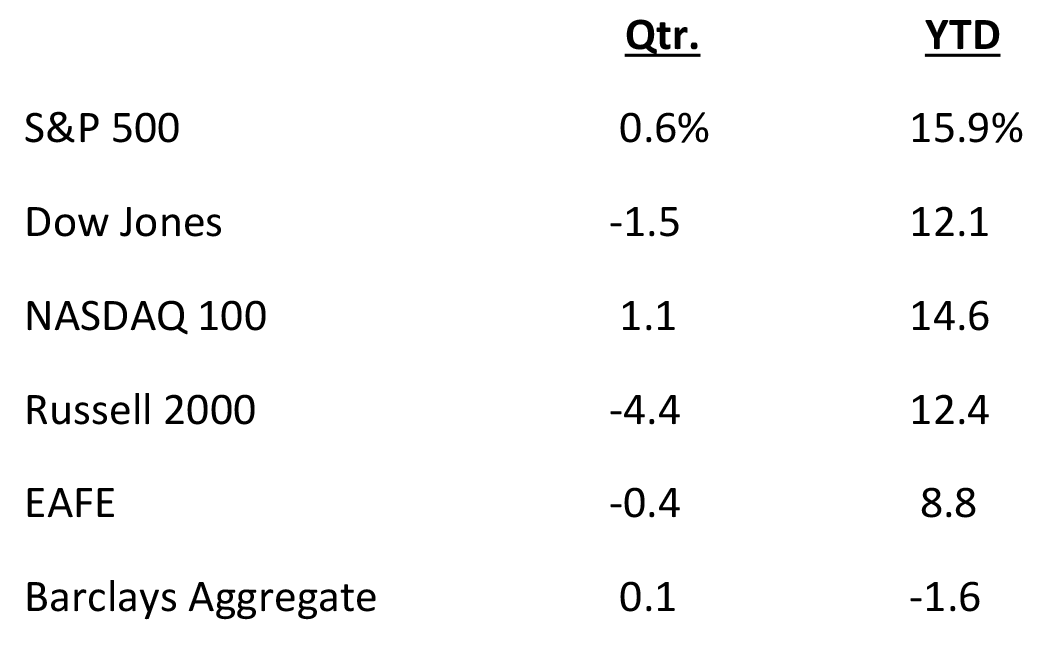

As shown below, despite the September weakness, markets were generally positive to slightly negative for the quarter with year-to-date returns remaining strong. During the quarter, large capitalization companies outperformed small caps while growth outperformed value. U.S equities remained the strongest on a global basis while developed markets strongly outperformed the emerging markets. Fixed income markets were generally flat for the quarter however with the September inflation fears, bonds sold off through the last two weeks of the quarter.

In our last quarterly writing we touched on the topic of the prospect of long-term inflation as a result of strong demand and Fed money-printing. We also touched on housing, which represents 1/3 of the overall Consumer Price Index (CPI). We identified a large future supply of housing stock in the U.S. as a potential offsetting impact on the risk of future inflationary pressure. This combined with the October revelation of a growing real estate crisis in China has added additional uncertainty, and to an extent further clouded the inflationary view.

Though, It is hard to argue that inflation is not presenting a clear and present challenge to consumers and business owners. This is especially true for low-income earners who have been hardest hit by the pandemic, and that suffer the most as prices for basic goods increase. However, the long-term rate of inflation is where the debate sits. All commodities, especially energy, are showing sharp increases due to global supply chain disruption and COVID related production shutdowns. We believe pricing will remain elevated but will moderate as the supply chain corrects and the restocking of shelves abates. Additionally, with the second largest economy in the world, a slowing China should add a dampening as China is the largest consumer of commodities. The impact of the supply chain on inflation is hard to understate and is revealed by separating inflation in goods vs services inflation in the U.S. economy. As you can see in the chart below, inflationary pressures within the services sector of the economy, though pronounced, have been much more tepid than that on the goods side. The chart depicts a breakdown of the 12-month percentage change of the Consumer Price Index (CPI), by all categories compared to just the Services components and is provided by the Bureau of Labor Statistics.

CPI has dramatically outpaced Services sector inflation in recent months. It has surged in excess of 5% since April of this year, was up 5.4% in September and at the close of October it increased to a concerning 6.2%. It had not previously exceeded 5% since the summer of 2008 and been higher than 6% since 1990. Ominously, both these prior time periods experienced recessions. The picture is a bit more comforting, though, when looking at the Services sector less energy where inflation has remained fairly in check. Curiously, over the past 20 years services inflation has run at a higher clip than CPI. This reflects the pivoting nature of the U.S. economy which has grown more service based in recent years and that segment of the commanding pricing power due to strong demand. However, CPI has drastically outpaced services inflation as we make our way out of the COVID crisis and the cost to import goods to the U.S. has temporarily increased forcing manufacturers to pass on those price increases to consumers. For example, prices have increased for new and used vehicles by 8.7% and 24.4% respectively through September of this year. Meanwhile the rent of a primary residence and owner’s equivalent rent were up 2.4% and 2.9% respectively. It is important to note that these increases are coming off of very low comps given the unprecedented complete closing of the economy in 2020. It is also difficult to foresee continued increases of this magnitude in the longer term.

No doubt the inflation debate has been a hot topic for investors and media pundits alike, but an even more dangerous concept emerged in September, instilling fright in investors. In part due to aforementioned economic challenges in China, and given the recent supply shocks, a growing concern developed that the global economy was not overheating, but rather slowing. This placed a considerable amount of pressure on already robust earnings expectations heading into the third quarter earnings season. The concern was that already existent inflation combined with a contracting economy would result in an even more dreaded stagflationary environment. Defined as persistent high inflation combined with high unemployment and stagnant demand, stagflation is feared because there really is no known antidote. This is because the normal responses to the two major components of stagflation—recession and inflation—are diametrically opposed. The cure for high inflation, or tighter monetary policy only acts to further punish the economy by further slowing growth and vice versa. Figure 2 depicts the google search activity for the topic “stagnation” the extent of stagnation concern entering into this fall.

As you can see, the last time the interest level was this high was in the months leading up to the great recession. Given this level of heightened interest a pullback in the markets in September is surely understandable.

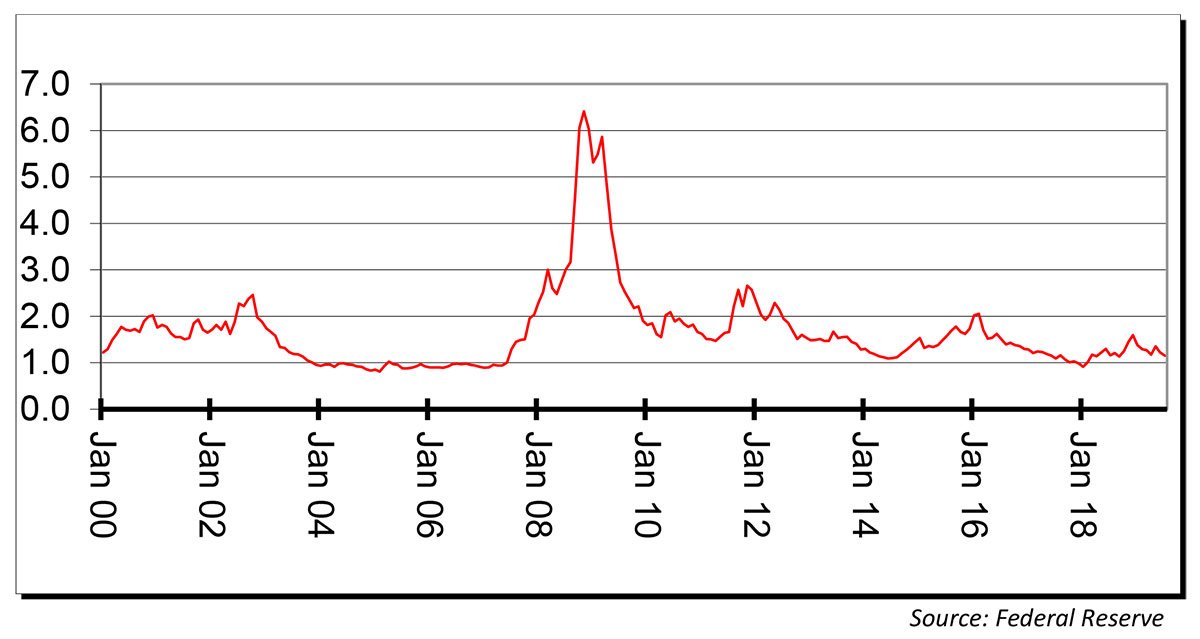

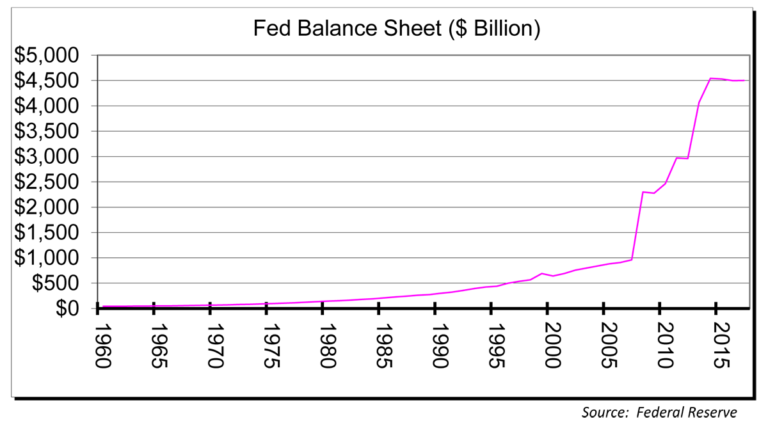

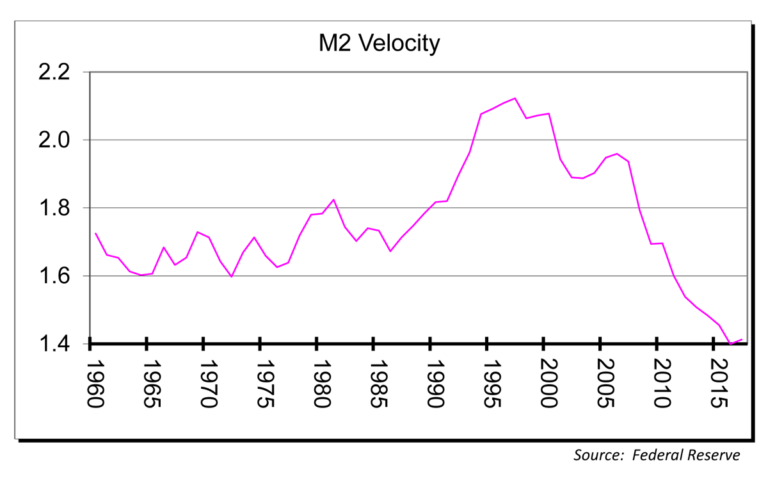

After all, a fear of rising interest rates is to be expected given the continued massive fiscal and monetary accommodation since the arrival of the Coronavirus. Afterall, the supply of U.S. dollars increased by an unprecedented 25% in 2020 alone! However, an increase in the money supply is not in and of itself inflationary. This is especially the case if the printed dollars end up not as loans, but as deposits on banks’ balance sheets or savings in investment securities portfolios. We have discussed this in previous writings. For the remainder of this writing, we thought we would focus on the other key ingredient for stagflation – a slowing economy.

From our perspective it is hard to find significant signs of a slowing economy. In fact, there are several key measures that brighten the growth side of the stagflation fear:

October aggregate hours worked has increased by approximately 5% indicating a stronger employment outlook.

Sentiment across manufacturing and service industries, as measured by the ISM Composite PMI, is reporting above 62 which has historically been consistent with GDP growth of 5-6% annually.

Consumer spending as measured by credit card receipts are increasing, signaling consumer confidence.

Travel, which is also a strong indicator of consumer confidence, is growing as COVID fears are abating with increased vaccinations and lower infection rates.

Lastly, and perhaps most important as it relates to the Alamar equity strategy – corporate profits are growing at a pace that is even higher than last year.

At Alamar, we are focused on actively managing a portfolio of companies and less focused on predicting the economy, we have witnessed a continued undeniable strength in corporate performance as of late.

For its part and as reported by FactSet, The S&P 500 is on track to report earnings growth in excess of 30% for the third straight quarter. Additionally, despite all of the inflation talk about compressing margins, the S&P 500 is so far reporting its third highest profit margin since 2008. So, despite the rising fears of stagflation and economic slowdown, we feel very good about the prospects for corporate earnings and continued growth (Figure 3).

Turning the discussion to Alamar and our approach to investing, it is important to again highlight that we seek to identify a limited number of investment opportunities to structure our client portfolios. At the center of our philosophy is the desire to invest in and own companies that have a proven ability to generate good earnings growth. We do not seek to own the entire market, such as an index fund or ETF, but instead want to own superior companies on a variety of financial and qualitative metrics. The economic backdrop of inflation, changing monetary policy or even the fear of stagflation only creates volatility and valuation opportunities for us to take advantage of. We are excited by the companies we currently own as they continue to meet and in many cases exceed our expectations for growth and profitability. Further, we remain confident more great ideas will surface as the economic landscape ebbs and flows around this earnings season, as well as those to come.

We will continue to monitor economic conditions and make adjustments to our portfolio based on individual company fundamentals. We sincerely appreciate the opportunity to invest alongside, and on behalf, of our current clients. We would welcome the opportunity to further discuss our investment philosophy, and process with those who have not found your way to invest with us yet.

Please continue to stay safe and healthy –

Best regards,

John Murphy, CFA Chris Crawshaw, CFA

DISCLOSURES

The views expressed in this note are initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss. Net of fee performance is calculated using the highest fee. The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The S&P 500 Index, which is a market-capitalization weighted index containing the 500 most widely held companies chosen with respect to market size, liquidity, and industry.

This publication is made available for informational purposes only and should not be used for any other purpose. This report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

ACM Commentary 2Q 2021

Halfway through 2021, our forecasts for this year are on track. Thanks to the rapid rollout of vaccines, the Covid-19 viral outbreak seems to be getting under control. While the emergence of variants such as Delta and Lambda needs to be watched carefully, studies so far indicate that the vaccines protect against severe outcomes. As a result, the US economy is booming! Almost all of our investments have beaten their outlook and raised guidance for this year. We expect this trend to continue for the rest of the year.

In our view, the biggest overhang on the market now is the prospect for long-term inflation. Many economists and market experts are forecasting a long period of rising inflation because of strong demand and Fed money printing. We are doubtful their forecasts will come to fruition. There are many long-term trends keeping inflationary forces at bay such as demographics (aging and slow growing population) and declining money velocity; we will delve into one important one – housing costs – in this note.

BACK TO THE 70’s SHOW?

Inflation, as measured by the Consumer Price Index (CPI), is rising rapidly recently. Figure 1 shows the CPI over the last six decades. After moderating for the last 30 years, headline inflation has spiked recently to over 5%. There are fears in the market that we may be heading to a period of sustained inflation reminiscent of the 1970s. Market experts point to rising prices of commodities such as oil, lumber, corn, wheat, and soybeans as indicators of inflationary pressures to come. Another factor, that directly hits consumers and is a large portion of the CPI index, is housing. Housing prices are rising across the board, particularly at the low-end. Figure 2 depicts the Case-Shiller index for national house prices. After peaking in mid-2006 house prices collapsed over 25%, bottoming out in early 2012. Now prices are booming again, up 85% from the bottom. The chart clearly shows that prices are once again moving away from long-term trends. The trigger for the breakout was the Covid-19 pandemic since prices didn’t begin their recent spike until 2H 2020. Covid-19 spurred a furious demand for homes because people wanted to get away from dense environments. Work-from anywhere allowed homeowners to move away from expensive urban, primarily coastal, cities to states like Texas, Nevada and Arizona where they could purchase newer, larger homes with a yard for a lower price. In many cases the monthly mortgage payment was lower than their prior rental payment due to low mortgage rates and cheaper land prices.

This dramatic increase in demand for housing has led to furious bidding wars for homes. Inventory for both new and existing homes have fallen to all-time lows. Figure 3 depicts months of available housing inventory at current selling rates. Housing inventory is now roughly 2 months for existing homes and below 4 months for new homes. This is a faster pace than back during the 2005 housing bubble when inventory for existing homes was 4 months.

Housing is a very important contributor to overall inflation since it represents approximately 33% of the overall CPI index. Hence, the future course of house prices, and more importantly, rents, will be crucial to determine the pace of inflation. So, why are we so

sanguine about future inflationary pressures given the dynamics affecting house prices? The answer lies in the future supply of housing. There is a tsunami of new housing units coming on the market in the next few years.

For many years we have surveyed new housing units built by a large group of home builders. Figure 4 plots the total single family units ordered and delivered by this group. As you can see from the graph, orders for new housing peaked in Q4 2005 at 83,000 units in our sample; deliveries followed 6 months later. Following the housing bust, units ordered and delivered fell 75% to roughly 20,000 units, bottoming out in 2011. Since then housing has been on a steady uptrend and has now accelerated with the onset of the pandemic. Orders this year will comfortably break the prior peak. It is a great time to purchase a new house, particularly if you are willing to relocate from the expensive coastal cities to the middle of the country. Unlike existing homes, new home prices relative to incomes have never been lower. Figure 5 plots new home prices in our sample and Figure 6 plots new home prices relative to per capita disposable household income.

As you can see, new home prices are averaging roughly $390,000 nationwide in our sample. Note that our sample includes all the major homebuilders who build homes across all regions of the country. Unlike existing homes, average new home prices have barely budged since 2015. To be sure, our sample captures geographic mix transfers as demand shifts across the country. When a homeowner sells their house in California and purchases a new house in Texas, demand shifts from an expensive to a more cost-effective region. Our sample captures this shift, while a price index such as the S&P Case-Shiller does not. If their income in Texas is roughly similar to what they were earning in California, their home price-to-income ratio will decline substantially. They will save a lot of money while at the same time upgrading to a brand new house with all the latest amenities.

We expect this dynamic to continue given the advent of work-from-anywhere and companies moving from expensive locales to more cost-effective interiors. As a result we forecast the delivery of new homes to continue to build from here. The supply of new, lower priced homes will inevitably dampen price increases on existing homes and rents. The best cure to a high price is a high price.

CONCLUDING THOUGHTS

We have a constructive outlook on the market for the rest of the year and beyond. We are finding good, reasonably priced investments in the current environment. Moreover, most of our current investments have easily beaten our expectations and raised guidance, and we expect that to continue this quarter. Unlike many experts, we are not overly concerned with long-term inflationary pressures. The biggest driver of inflation, housing costs, will likely ameliorate over time as a surge of new housing supply hits the market. There has never been a better time to purchase a new home, especially if you are a renter in a high priced coastal city, provided you are willing to relocate.

Thank you for your continued trust and confidence in Alamar Capital Management.

Sincerely,

George Tharakan, CFA

george@alamarcapital.com

Disclosures

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss.

This publication is made available for informational purposes only and should not be used for any other purpose. In particular, this report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

ACM Commentary 1Q 2021

With the arrival of March, we stumbled across the one-year anniversary of the COVID-19 related global lockdowns that resulted in the fastest and deepest contraction in the economy since WW II. There is much to celebrate this spring, most notably continued and accelerating progress on the vaccination front.

By the end of March more than 150 million Covid vaccines had been administered in the United States. As of this writing, more than 3 million shots are being injected into the arms of U.S. citizens per day. A remarkable scientific achievement, especially given where we were just 12 months ago. It is likely that Covid-19 will be with us for many years to come and a continual evolution of the virus with additional strains is to be expected. However, the march towards herd immunity continues, and fortunately, the current round of vaccinations has proven effective against known mutations so far. In one of the largest signs of progress, just this week the CDC lifted mask requirements in outdoor spaces for US citizens who are fully vaccinated.

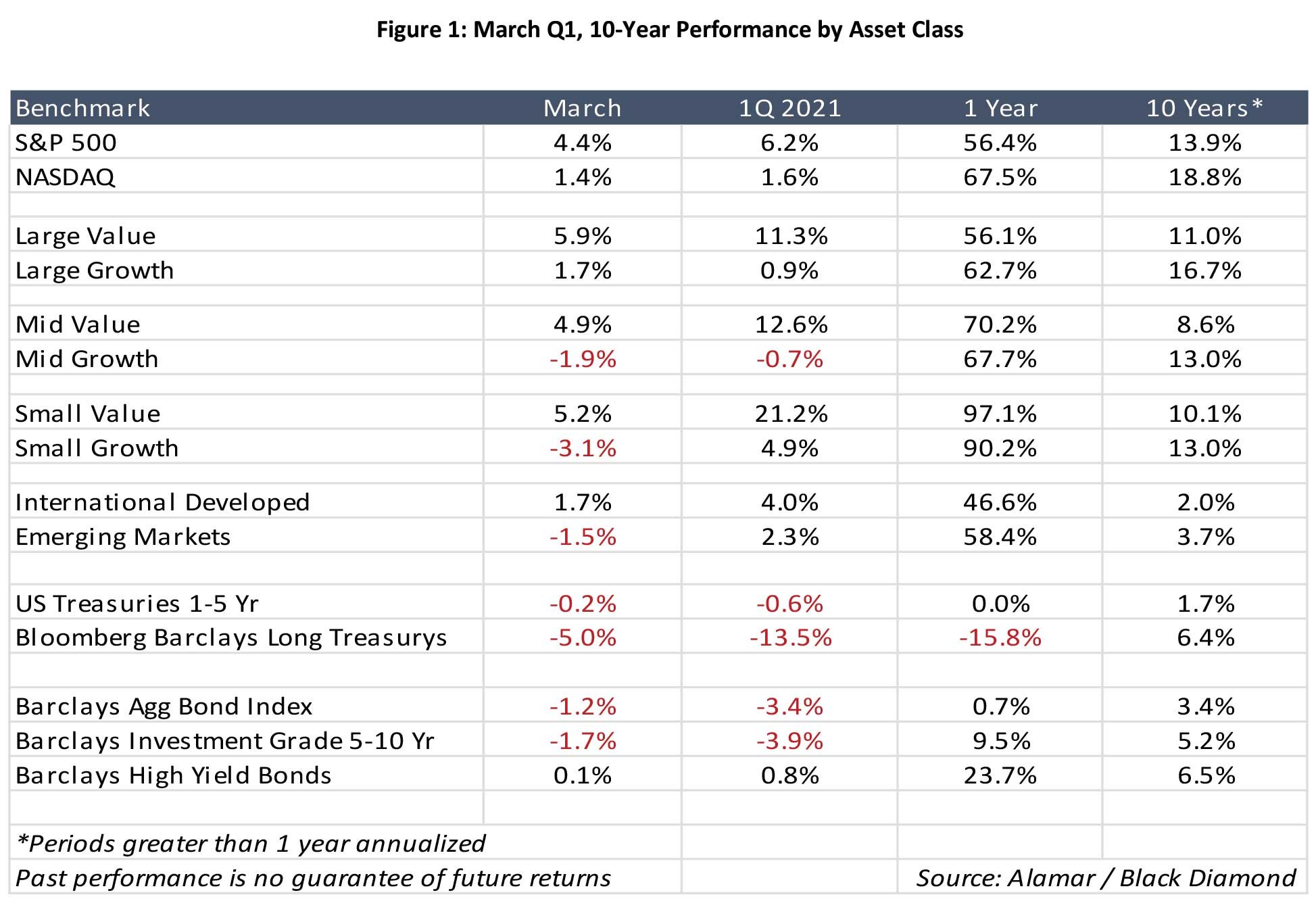

This news, combined with the continuation of massively accommodative fiscal and monetary policies, added to an already pre-existing risk on sentiment for investors in the quarter. This was particularly evident in the month of March as shown below. For our part at Alamar, we anticipate the economy to continue to accelerate in the months ahead given the continued steady reopening of the economy’s service sector and strong monetary and fiscal support. The returns in the market are, of course, more difficult to predict in the short term. However, it is fair to say that few, if any, investors anticipated the returns that have been generated and the progress that has been made in the past year. Additionally, a sudden and dramatic spike in interest rates during the quarter, attributable to inflationary risk, has begun to fray investor nerves, particularly in the fixed income market. The chart in Figure 1 below depicts the performance of various asset classes over several different time periods.

As you can see from the chart, equity investors across the board were rewarded in the quarter, with value outperforming growth. As we discussed towards the end of last year, we view this as a positive development relative to the health of the overall stock market. Older economy value names have reacted favorably to progress on the vaccination front and the beginning of the end of the Covid crisis. Additionally, a spike in interest rates had a deteriorating effect on the valuations of higher-growing companies in the economy. The present value of their future cash flows is discounted back at a higher-level, necessitating lower current valuation.

Likewise, higher rates had a similar negative impact on the fixed income market. This is because higher current interest rates require that bond prices be reduced to allow the purchaser of a bond to secure a yield that is in line with the current environment, not the date in which the bond was issued. In what has been a very low interest rate environment, credit investors have been left with two choices to increase the yield in their portfolios: either extend the maturity of the bonds they purchase- in simpler terms lend money for a longer period- or increase the credit risk of their portfolio by lending to less creditworthy borrowers. A continued improvement in the economy saw a varied outcome based on these two choices. High yield bonds sought out small gains in the quarter as credit spreads shortened and defaults reached multi-year lows. Meanwhile, the bell weather Barclays Aggregate bond index was down -3.4% in the quarter, while intermediate corporate bonds fell by a similar -3.9%. With long-term treasuries down -13.5% in the quarter. Investors who lent out for the long haul were hit the hardest. This recent move reverses a trend in the earlier innings of the Covid-19 Crisis, when the dramatic and somewhat shocking fall in rates rewarded long term bond holders. The sharp move in rates in the quarter can be seen in the chart below, which depicts the yield on 10 Year US treasury bonds dating back to before the financial crisis.

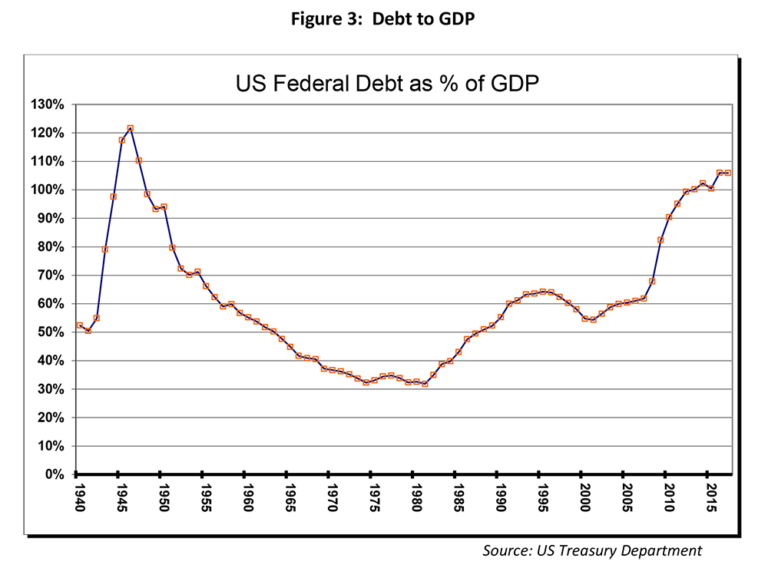

The current prevailing view is that Real GDP growth in the U.S. economy will exceed 6% this year and the recent move in interest rates is attributed to the view that the combination of stimulus and rapid growth will lead to rising prices. After all, the U.S. Economy experienced stubbornly high inflation in the 1970’s and early 1980’s, last reaching double digits in 1981 (Figure 3). It is the view of most economists that this was caused by overly expansionary monetary and fiscal policies, along with significant increases in energy prices. That resulted in Fed Chairman Paul Volker courageously raising short term interest rates in the early 1980s to bring down inflation, but at the cost of a recession. Since 1991 inflation has remained below 5%. Further, for the great majority of the period since the 2007 – 2009 Great Recession, inflation has been below the Fed’s target of 2%, which it established as its goal in 2012. This, despite fiscal and monetary policy, has been dramatically more stimulative than the high inflation period of the 1970s and early 80’s.

The question left for investors today is whether things are different this go-around, or if we are doomed to repeat the same fate. For our part at Alamar, we are not convinced inflation is at hand, at least not yet, and the Federal Reserve appears to agree with us. The Great Recession and COVID-19 induced recession represent the two deepest recessions since the Great Depression. In both downturns, rapidly rising unemployment made inflation unlikely. Despite the massive stimulus, inflation has remained contained, as unemployment rates had been falling dramatically in the years preceding the COVID-19 pandemic.

This has likely emboldened the Fed. Overlooking growing concerns, they have pledged to keep short-term interest rates at zero until the economy reaches full employment and inflation is modestly above 2%, which Fed leadership does not expect until 2023 at the earliest. Figure 4 below is provided by the St. Louis Fed and it indicates both their actual and projected inflation rates in the near term.

Their projections for inflation include a brief spike in the spring and then a convergence back towards the pre-pandemic average nearing the end of 2021. In other words, we should not expect the Fed to react to a “temporary” rise in inflation. This view, combined with continued stimulus is a bullish indicator for the equity markets, and perhaps even fixed income if the Fed’s thesis plays out as predicted.

On the fiscal side the budget deficit is projected to be around 15% of GDP in 2021. On March 11th, the $1.9 trillion American Rescue Plan was signed into law. This stimulus clearly acted as a tailwind for the economy, enabling many to purchase necessary goods and services.

However, another large beneficiary appears to be the stock market itself. According to data aggregation company Envestnet Yodlee, many consumers used at least some of that money to speculate in the stock market; their research indicates that securities trading was among the most common uses for the government stimulus checks across nearly every income bracket. Interestingly, the numbers were particularly high for those in the $35,000 to $75,000 income bracket, where trading came in third behind only increasing savings and cash withdrawals.

Not to be outdone by the American Rescue Plan, further fiscal stimulus has been proposed through a $2.25 trillion American Jobs Plan. Anticipated to be spent over 8 years, the plan has garnered much attention for its very broad interpretation of “infrastructure”. The plan is summarized below in Figure 5.

Though it does commit up to $621 billion to politically consensus building infrastructure-oriented segments like highways bridges and roads $115 billion, Public transit $85 billion and passenger and freight rail $80 Billion. Much to the consternation of many Republicans, it also incorporates a $650 billion Infrastructure at Home component allotted to investments less related to infrastructure, such as $213 billion reserved for affordable and sustainable housing and $137 Billion for public schools. Further, the plan allocates $400 billion to a Caretaking component for home and community-based care for the elderly and disabled. A closer look at the traditional Transportation and Infrastructure segment also shows $174 billion reserved for electric vehicles. In recent days, the Republican leadership has offered a scaled-back $800 billion Infrastructure plan of their own. It is clear further negotiation will lead to a deal.

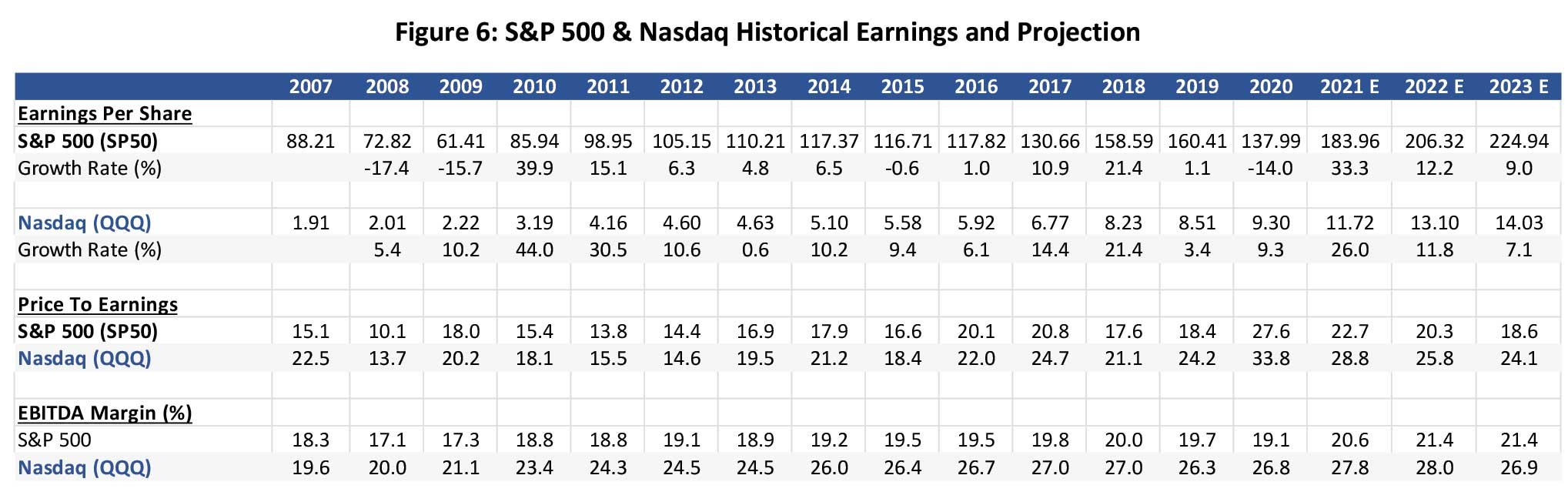

Shifting our focus to the stock market, the picture is also quite rosy at present. So far in the first quarter, earnings growth has been very strong, with a significant number of companies in the S&P 500 beating already optimistic Wall Street expectations. Below you will find historical and projected earnings and profitability on the S&P 500 and Nasdaq dating back to the Great Recession. As you can see from the chart, according to FactSet projections the S&P 500 is currently projected to grow earnings by 33% in 2021, and 12% in 2022.

The newer economy Nasdaq is projected to grow at slightly lower levels, but with considerably higher profitability (Ebitda margins) over the same period. Also notable from the data has been the propensity for the Nasdaq names to achieve positive EPS growth during both the 2008-09 Great Recession and the last year (9.3% vs -14.0%), a feat that the S&P was not able to accomplish.

The combination of Covid pandemic relief, massive fiscal and monetary stimulus, accommodative Fed posturing, and solid earnings and profitability growth has made for strong market returns and a nice back drop for the economy and market looking forward. At Alamar, we continue to find attractive ideas for investment in our portfolio.

Please continue to stay safe and healthy –

Best regards,

John Murphy, CFA

DISCLOSURES

The views expressed in this note are initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss. Net of fee performance is calculated using the highest fee. The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The S&P 500 Index, which is a market-capitalization weighted index containing the 500 most widely held companies chosen with respect to market size, liquidity, and industry.

This publication is made available for informational purposes only and should not be used for any other purpose. This report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

ACM Commentary 4Q 2020

Last year was one for the history books. In our view, historians and scientists will look back and be aghast at the sheer lack of preparation and ineptitude at all levels of government to deal with the COVID-19 outbreak. We hope you and your family are staying safe and healthy during this pandemic.

Alamar’s equity portfolio was up 40.9% last year while the S&P500 was up 18.4%. Since starting in 2010 our equity portfolio is up 15.8% annualized while the S&P500 grew 14.0%. A client who invested $1 Million with us at our inception would now own a portfolio of stocks worth over $5 Million. A large portion of the performance of the S&P500, once again, came from just a few stocks (FAMAA – Facebook, Apple, Microsoft, Amazon and Alphabet). In fact, more than half the performance of the S&P500 last year came from just these 5 stocks! Most large stock indices such as the S&P500, Russell 1000 and the NASDAQ 100 are now overly reliant on these 5 stocks, plus Tesla and Netflix, to power their performance, a very precarious position, in our view. We have never owned any of these stocks. We are pleased to report Morningstar recently ranked our performance against our peers and the Alamar Equity portfolio was awarded 5 Stars, their highest ranking, in all time frames. In addition we received the top risk-adjusted ratings (performance when adjusted for the risk incurred) when compared to our competitors. Avoiding the crowded and popular investments has served us well.

The economy is set to boom this year. Both fiscal and monetary policies are extremely accommodative. The biggest headwind facing the economy is the spread of the COVID-19 pandemic; however, we believe we are close to turning the corner as explained in this note. We will also explore the cost of being overly cautious or indecisive when investing in public equities.

THE HIGH COST OF DITHERING

When new clients join Alamar, they are usually moving from another investment manager. The clients are typically dissatisfied with the performance of their investments, the poor client service, or both. When evaluating their existing investments we inevitably see an equity portfolio with anywhere from 10 to 20 ETFs and mutual funds, sometimes sprinkled with a few popular names such as FAMAA, Netflix or Tesla. A portfolio composed of 10 or more ETFs/Mutual funds is destined for mediocrity. It exposes a lack of investing acumen or experience. Each ETF or mutual fund may own anywhere from 100 to over 1,000 securities. As a result the client effectively has invested in a portfolio of over 2,000 securities without realizing what has occurred. A portfolio with such a large number of securities indicates a lack of conviction and analysis. The managers are unwilling or unable to make a decision on where to focus their attention, to look for mispriced securities, to have a viewpoint on the economic fundamentals and to perform the hard work required to unearth great investments. Such a portfolio is doomed to mediocre performance. We looked to see if this was a widespread phenomenon and found a working paper written by Professors Sandeep Dahiya and David Yermack1. The paper looks at the investment returns of almost 30,000 endowment funds from 2009 to 2017. For 2018 and 2019 we used the returns from the NACUBO survey of 774 colleges and affiliated foundations. While these are not completely comparable, a large portion of the total endowment assets are managed by colleges and universities.

Figure 1 depicts the performance of the average endowment compared to an Alamar equity account and a simple 60/40 index (60% in S&P500 and 40% in a bond index such as the Barclays US Aggregate). We have left out the 2020 performance for endowments since they are unavailable as of this writing but we expect roughly 7% returns from early reports disclosed so far. The series are not entirely comparable because college endowments get access to many illiquid investments through venture capital, private-equity, real-estate and hedge funds while Alamar’s portfolio is composed entirely of liquid, publicly traded stocks in the US. However, we invest in a fairly concentrated portfolio of 35 to 50 securities while an average endowment probably has well over 100 once the ETFs and funds are fully decomposed. Therefore the average endowment may be less aggressively positioned or embracing less risk than Alamar.

As seen above, the average endowment, by spreading its bets across many asset classes and securities, has woefully underperformed Alamar and even the 60/40 allocation. The clients who join us from other managers have experienced similar performance.

OUTLOOK FOR 2021

The economy is set to grow rapidly this year. Tailwinds include:

A very accommodative Federal Reserve (real interest rates are negative across most of the yield curve)

Large fiscal deficits

Control of the Presidency, House and Senate with one party making it easier to pass large spending bills.

A weak US Dollar boosts exports and also provides benefits when companies translate overseas sales.

In addition, we believe the news from the COVID-19 pandemic should soon start to get better. A recent paper in the Journal of American Medical Association (JAMA) 2 estimated that roughly 14.3% of the US population had been infected with the SARS-COV-2 virus as of November 15, 2020. Assuming a similar growth trajectory in the infection rate we estimate roughly 30% of the population will have been infected by the end of this month. In addition, with the advent of mass vaccination with vaccines from Pfizer/BioNTech and Moderna, we forecast another 10% of the population will be vaccinated by the end of January. As a result, roughly 40% of the population will have either been exposed to the virus or vaccinated very shortly, getting close to the herd immunity threshold of 60% (assuming a 2.5 reproduction number). New infections should start to materially decrease as we get closer to the immunity threshold. Needless to say, our forecasts are based on assumptions gathered from our readings of numerous publications of the CDC, JAMA and others. We are closely monitoring the ongoing spread to determine if it follows our projections.

A growing economy and a slowing infection will fuel corporate profits. Current estimates call for a rapid increase in profits this year. Figure 2 plots operating profits for the S&P500 since 1960. After dropping 23% in 2020, profits are expected to get back on trend this year, growing 36% to roughly $165 per share. Given the aforementioned tailwinds there is no reason not to expect continued growth in profits next year and beyond.

With such a favorable backdrop, we expect many investment opportunities throughout this year. After a long drought, a plethora of companies have begun to tap the public markets. The recent change by the SEC to allow direct listing by private companies to raise new capital is a very exciting and material development. We expect many companies to tap this route as it avoids the costly and time consuming roadshow to go public. It is also a far more equitable way to allocate scarce shares of newly public entities.

Similarly, we expect a spate of mergers & acquisitions this year as managements gain more confidence in the economic prospects. Interest rates are low, capital is plentiful and banks have plenty of capacity to lend. We have already had one of our largest investments, RealPage, receive a proposal to be acquired by a private-equity firm for over $10 Billion. At the buyout price we will have made over 3 times our investment since we purchased the stock 4 years ago.

CONCLUDING THOUGHTS

Clients who have been with us over the last 11 years have enjoyed a great return. While we cannot expect to repeat the spectacular performance achieved last year, we do believe a long-term investor in our equity strategy will continue to reap rewards as we uncover new opportunities. As we have mentioned before, the pace of change is accelerating and entire industries are being disrupted. New innovative companies led by great management teams are reimagining the playbook. Investors, meanwhile, are overly enamored with a few popular stocks (FAMAA plus Tesla and Netflix), leaving plenty of opportunities for us to prospect. Focusing on a few good ideas provides a much better outcome in the long run than spreading your bets far and wide. As long-term investors, we embrace the magic of compounding returns in a very tax-efficient manner.

We are optimistic our great scientists will get the upper hand on this novel virus. After a troubling initial rollout, the progress on testing and vaccination should accelerate as bottlenecks are removed, getting us closer to herd immunity. The fiscal and monetary stimuli coupled with a waning pandemic should unleash growth across the economy. We are well positioned to participate as opportunities arise.

Thank you for your continued trust and confidence in Alamar Capital Management.

Sincerely,

George Tharakan, CFA

george@alamarcapital.com

1 Investment Returns and Distribution Policies of Non-Profit Endowment Funds, Sandeep Dahiya and David Yermack, SSRN March 2020

2 Estimation of US SARS-CoV-2 Infections, Symptomatic Infections, Hospitalizations, and Deaths Using Seroprevalence Surveys, Angulo et. al. JAMA Jan 5, 2021

Disclosures

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss.

This publication is made available for informational purposes only and should not be used for any other purpose. In particular, this report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

ACM Commentary 3Q 2020

Though it is already well in the rearview mirror, the third quarter saw a continuation of the market’s dramatic recovery from the Covid-19 pandemic. Thus far, this trend has continued into the 4th quarter. Through the end of November, the S&P 500 is now up 64% from its March 23rd COVID Pandemic low. Over the same period, the Nasdaq, heavily comprised of emerging growth technology companies, is up 79%! The chart below depicts the S&P, Nasdaq, and Dow Jones Industrial Average performance for the year. It does an excellent job of pointing out what appears to be a disparity in outcomes between “old economy” companies represented by the Dow versus their “young economy” company NASDAQ peers. This disparity, of course, is sadly ironic given that the COVID-19 health crisis itself has cut along similar lines. It carries with it financial, social, and political consequences that we will be contending with for years to come.

Figure 1: Performance Comparison 2020 (11/30/2020)

Surprisingly, the Dow fell further than the S&P and Nasdaq into the crisis and has also been slower to recover. This fall mirrors the pandemic itself, which has been much harder on the older segment of society than the young. Likewise, the market has been much harsher on more mature sectors of the economy while leaving the young, faster-growing technology companies, representative of the NASDAQ, relatively unscathed. This phenomenon runs counter to what investors have come to expect from the equity markets during periods of heightened volatility.

Typically, high flying, higher P/E growth companies are often the first to fall back to earth during corrections, as investors flee their names for the safer shores of traditionally defensive sectors of the market like Utilities. Until just recently, this has not been the case. Surprisingly, High dividend-paying stocks lagged dramatically through the recovery. Though perceived as an attractive alternative to low yielding bonds, the dramatic reduction in interest rates was not as advantageous as younger higher growth companies. High growth companies are rewarded in lower interest rate environments as that future growth is discounted back to a higher present value than when rates are higher. The low rate environment works to justify their higher stock prices. Making matters worse, the employees of “old economy” companies, and those employed in the service sector, have seen their lives dramatically impacted from both the risk of the virus as well as the government’s response. For example, when job losses were at their recent peak, wage growth in the U.S. went up, not down, indicating that most jobs lost were lower paying.

On top of being extraordinarily unfair and tragic, this outcome has also likely been very frustrating for traditional value investors on the investment front. After lagging the growth crowd during the entirety of the great recession recovery, they were doubtless anxious to show their wares during an environment that typically would appear to be more favorable to them (Figure 2).

Figure 2: The Value vs. Growth Divide as of 11/30/2020

As you can see from the chart, growth has been handing it to value for some time. Perhaps, most notable is that value strategies of all stripes are still down on the year. Recently there have been some early signs that growth’s market leadership may be changing. The scientific community has done a tremendous job with three drugmakers, Pfizer, Moderna, and AstraZeneca, successfully developing vaccines well ahead of schedule. Clinical trials have shown all carry very high efficacy rates and, so far, limited side effects. This development, which represents the beginning of the end of the COVID-19 pandemic, has given investors the comfort to return to the broader economy equity markets and result in a pivot in market leadership. As a result, value outperformed growth across the board in November and the 4th quarter. A promising sign for many reasons.

At Alamar, we believe a stock market where many companies find success much more favorable than a narrow market only rewarding a few. As we have stated several times in the past, we are wary of equity markets driven by just a few FAANG names, as they result in too many investors leaning on them for returns. In our experience, these types of crowded trades eventually end badly. An environment that rewards many economic sectors relative to a few is a sign of a healthier market and economy.

Additionally, the equity markets have reacted favorably to the end of the uncertainty associated with the recent election season. Perhaps most specifically, equities have responded favorably to the lack of materialization of a heavily predicted Democrat blue wave mandate for change. Because of this, there is a good chance that the Biden administration will face challenges to fulfill some of its more aggressive Campaign promises like selective tax hikes. These two outcomes, the recent arrival of a vaccine and the end of the elections, have combined to squeeze more uncertainty out of the stock market. It is also likely that they have helped to settle some frayed investor nerves. However, we are aware that many remain skeptical.

Their skeptical view brings us to another topic that we would like to discuss with the rest of this letter. In many of our recent conversations, we have noticed a recurring theme or a prevailing view that given how badly things have gone in 2020, it just seems irrational for the stock market to have done so well. Completely understandable, but we want to share some views on this, which might seem to be a bit counterintuitive at first, like the tech sector’s big run this year.

WHERE’S THE PUCK

We should forgive investors for thinking the equity markets should still be down big this year. In our lifetimes, we cannot recall a period in which we were confronting so many simultaneous challenges and so much uncertainty. In just nine months, we have encountered a global health pandemic, the shuttering of the worldwide economy, the loss of more jobs than any period since the great depression, and the sharpest market decline in recent memory. In the U.S., we have experienced a less than stellar response to the crisis by our government leaders of all stripes, not to mention a genuinely uncivil election season. At present American citizens are openly questioning their safety at the police’s hands, while others question the lunacy of a defunded police force. Lastly, we have watched these issues unfold while being locked into our homes. At times, this can feel like just too much. The chart below aptly summarizes this sentiment. It depicts Real GDP Growth dating back to 1960. A period of time that experienced eight separate recessions highlighted in grey, with the first seven do an outstanding job of putting the most recent 8th one into perspective.

Figure 3: Historical Real GDP 1960-2020

After stalling in the first quarter, GDP fell an unprecedented -9.2% in the second quarter and a further -2.9% in the third, in the first planned recession in U.S. history. The economic shutdown’s orchestrated nature enabled an almost immediate response, with massive ensuing monetary and fiscal stimulus. This quick response was unusual in that historically; it is often difficult to determine precisely when the U.S. economy enters a recession, defined by two sequential negative quarters of GDP growth. Due to this, there is typically a delay in our federal response, making the recent recession unique. The sharp decrease in GDP was terrifying, though, no matter how you want to look at it. And it certainly does not look like an environment that equity markets would perform well. Interestingly, when you take the same GDP data as before and layer the U.S. Equity markets’ performance over the top of it, this outcome grows more likely as we begin to see the forward-looking nature of markets.

As you can see from the graph, even though we are inclined to look for one, there does not appear to be a connection between stock returns and GDP. In the most recent correction, U.S. Stocks were up in the second quarter by 12.6%. In the same quarter that GDP was down -9.2%.

Figure 4: ALL US STOCKS vs. GDP 1960-2020

Looking back over prior years, this does not appear to be an anomaly. There is a statistical measure that we can use to test what our eyes are seeing, known as regression analysis. It allows us to attempt to measure the relationship between two independent variables., in this case, stocks and GDP. For example, regression analysis can be utilized to determine whether there is a correlation between GDP growth or contraction and stock prices and how strong that relationship is. A correlation of 1 conveys a strong positive relationship, or in other words, if GDP increases, so do stocks. While -1 indicates a strong inverse relationship, meaning that if GDP increases, it is likely that stocks go down. Lastly, a correlation of 0 indicates no real relationship at all. We conducted a regression analysis on GDP’s connection to US Stock prices over the 60 years, and the results are displayed below.

Figure 5: Correlation of US Stocks VS GDP 1960-2020

The data shows that the correlation between the current quarter for stocks and the same quarter for GDP is -0.05, which indicates no relationship between the two variables. The present quarter stock market return must be plotted against GDP one quarter in advance to achieve a small correlation (.12 on the chart). Plot the same stock return against GDP 2 quarters in advance, and the correlation increases further to .23, a still-fragile relationship, and so on. There are better predictive variables to compare stock returns against than GDP – we like earnings growth and free cash flow. However, the chart and regression analysis speak to the forward-looking nature of markets in its attempt to predict the future. All-time hockey great Wayne Gretzky once famously said, “I skate to where the puck is going, not where it has been.” As investors, we would be wise to follow his lead because overly fixating on the present will likely result in missed opportunities.

SUMMARY

The market has staged a dramatic recovery in the latter part of 2020 thus far. With low-interest rates and a transition in the economy to a remote working environment, less capital intensive and higher growth technology businesses have thrived. Meanwhile, the relatively safe, slower growing, and lower P/E names that we think of in times of crisis have until just recently, have lagged their higher growth peers. This recent pivot towards value is a good sign as it reflects a healthier economy. It also shows investors looking forward beyond the recent elections and towards a world with a vaccine for the virus.

It is understandable to question the markets run given the economic environment, though instructive to understand the pockets that have experienced the lion’s share of the appreciation and why. Additionally, the correlation between heavily scrutinized figures like GDP is a poor measure of near-term stock market performance. Like Gretzky, the market is much more focused on where the puck is going than where it has been. However, there is a current surge in the number of those sick with the coronavirus. The arrival of at least three highly effective vaccines, gives us much to be thankful for and a future in which to be optimistic! Something for all of us to reflect upon as we live in real-time through some challenging circumstances.

Lastly, we would like to share a quick update on Alamar. For those of you who are clients, we are very grateful to have you investing alongside us on this journey. Though we initially underestimated the impact of the COVID-19 crisis, we were nonetheless well-positioned and have had an excellent year. We have a propensity to identify and invest in companies in the earlier stages of their lifecycle, many in technology. As we have stated, this has been a real sweet spot for the market this year. Our flagship Alamar Equity strategy is up 30.6% net of fees through November, handsomely exceeding our expectations as well as our benchmarks on the year (Russell 3000 +15.7% / S&P 500 +14.0%). The considerable outperformance this year has added to our lead relative to the market since inception. Since our inception on January 1st, 2010, the Equity strategy is up 16.7% annualized net of fees, while the Russell and S&P are up 13.4% and 13.6%, respectively. Also, to share a bit more good news, we are delighted to report that our strategy was recently awarded a highly coveted 5-star rating by Morningstar, a database covering separate account managers such as ourselves. We would be happy to share this report with you upon your request. Much to be thankful for indeed.

Please continue to stay safe and healthy –

Best regards,

John Murphy, CFA

DISCLOSURES

The views expressed in this note are initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss. Net of fee performance is calculated using the highest fee. The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The S&P 500 Index, which is a market-capitalization weighted index containing the 500 most widely held companies chosen with respect to market size, liquidity, and industry.

This publication is made available for informational purposes only and should not be used for any other purpose. This report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

ACM Commentary 2Q 2020

While it’s only been six months into a new year, it seems like a decade has gone by! To say this year has been full of surprises would be a severe understatement. Even in our worst nightmares we are unable to dream up a sequence of – a worldwide pandemic, racial divisions & protests, severely disparate health outcomes from the pandemic crowned with inept leadership in response to the rolling crises! We sincerely hope you and your loved ones are staying safe and well during these tumultuous times.

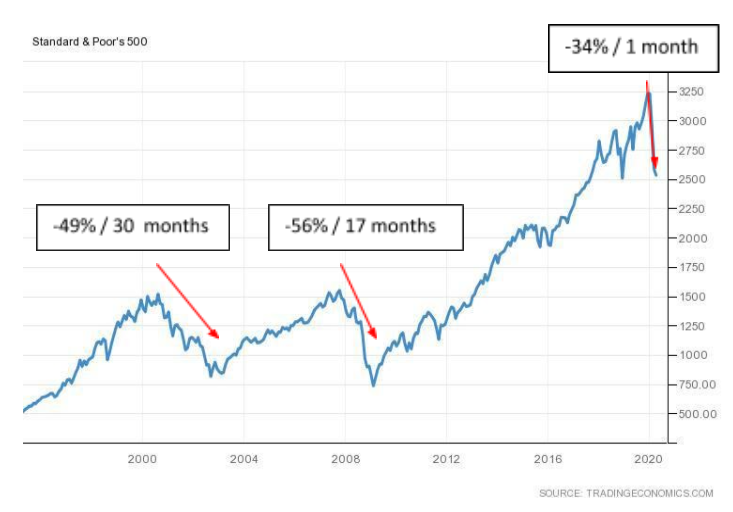

This is our third crisis since we began our investing career over two decades ago. First was the technology & telecom bubble and subsequent crash in the late 90s, followed by the housing and financial crises of 2007-2009. Now we face a healthcare and societal breakdown driven by the SARS-COV-2 virus. This crisis is much worse than the others because of its speed and the large number of fatalities primarily driven by unpreparedness and incompetence. Even now, over six months into the pandemic, policy makers are still stumbling around with no cogent response.

One thing that has not changed this year is the narrowness of the US stock market, driven primarily by FAMAA (Facebook, Amazon, Microsoft, Apple and Alphabet). We wrote extensively about this phenomenon in the past and will not belabor the point in this note. The S&P500 was down 3% in the first half of this year, but excluding these five names, the market would be down over 11%! This stark difference in performance, in our opinion, explains in large part, the divergence between the dismal state of the real economy and the optimism of the stock market. As you are aware, our portfolios have performed very well this year despite not investing in these crowded investments.

Like many of you, we have spent an inordinate amount of time in the last few months reading and trying to understand the science and progression of COVID-19. In this note we will share some of the results we find interesting. We will close with some general observations of the investing landscape as we see it midway through this very consequential year.

Also noteworthy – we moved into new offices earlier this year (a few blocks from our old location) and our registration with the SEC went into effect a few days ago. Clients all over the country can now utilize our services.

COVID-19: THE GOOD, THE BAD & THE UGLY

In this section we will attempt to distill what we know about the virus (SAR-COV-2) and the resulting disease (COVID-19). We will also provide references so you can verify all of our statements. As much as possible we have ignored the media, the so-called TV-pundits and politicians but instead relied on published science. Needless to say, this is a novel virus and scientists continue to unearth new findings. We are nowhere close to fully understanding the long-term effects of this pandemic.

The good news about this disease is that with a few simple steps and good leadership it can be controllable. Countries such as China, Australia, South Korea and Singapore have shown how it is done. Even countries such as Spain and Italy that were caught by surprise and entirely unprepared have now brought the disease spread under control.

Figure 1 plots the new cases (7 day average) and deaths (7 day average) in Italy since the onset of the pandemic. As you can see, Italy was overwhelmed by cases at first and was on the front page of the news daily in March and early April. Cases peaked in late March followed by deaths a week later and since then both have trended down. The figure for Spain, another country hit very hard early on by the pandemic, looks similar.

After being taken by surprise and overwhelmed by the rapid speed of transmission, the Italian government instituted full lockdowns of certain cities to slow the spread. Obtaining reliable and current data on outbreaks allows governments to stamp out the viral fire.

Unfortunately, here in the US the threat detection and responsiveness continues to disappoint, even now, six months into the crisis. Figure 2 plots the same statistics for the US.

As seen in the plot, the US did not experience the rapid onset of cases until two weeks after Italy, beginning mid-March. Since then the virus continues to spread, primarily due to haphazard, uncoordinated leadership. Hotspots flare up followed by a temporary, porous lockdown but the virus quickly reemerges with more strength once the restrictions are lifted. Death numbers came down but are now trending up after bottoming at roughly 500 a day.

After surveying the responses of various countries and reading papers in scientific journals, we are optimistic of the disease prognosis. Here are a few of our observations:

The disease can be brought under control with the implementation of the right policies (see Italy, Spain and the State of New York).

Even after bringing it under control the virus cannot be fully eradicated. Despite the success of countries such as Singapore and South Korea, they continue to see small viral outbreaks. We will need persistent, eternal vigilance.

Wearing simple cloth masks does reduce the spread of the virusi.

Even though the symptoms initially manifest in the lungs – giving rise to difficulty breathing for instance – the disease seems to primarily affect the cardiovascular systemii.

Cardiovascular disease, obesity, sickle cell disease, cancer and Type 2 diabetes are the biggest associative comorbidity factorsiii. This finding is in accord with the prior observation.

The case fatality rate (CFR) increases exponentially with ageiv.

The case fatality rate disproportionately impacts Blacks and Hispanics in the USv.

Neutralizing Antibodies (nAb) produced by the body in response to an infection seem to dissipate within 100 days.vi Hence we are likely to get reinfected with the virus.

A simple color coded website, constantly updated by the CDC, showing county-level infection and fatality data, could bring pressure on counties to bring infection rates under control. For instance, see the website maintained by Harvard University – https://globalepidemics.org/key-metrics-for-covid-suppression/

We conclude, based on the evidence so far, the virus that induces COVID-19 will be with us for a long time. It will be very difficult to completely eradicate. The virus will likely mutate over time as influenza viruses do. However, as in all prior pandemics, we can, with the right policies, bring the current one under control.

INVESTMENT OUTLOOK

While we did not anticipate the onset of this pandemic at the start of this year, we were nevertheless well positioned coming into the crisis. Many of our long-term investments have done very well this year such that we are comfortably ahead of market benchmarks. Moreover, we took advantage of the selloff earlier this year to initiate new positions in companies that were on our radar for many years.

The trend toward passive investing continues unabated and this year in particular has seen a dramatic acceleration. As we have noted in the past, passive investing leads to the larger weighted companies in an index garnering a disproportionate share of investor dollars. All else equal, these flows lead to share prices of larger names rising faster than the rest which in turn attracts more investor attention – a self-fulfilling cycle of riches! This year provides clear evidence of this phenomenon. The market, as defined by the S&P500, is down 3%. Remember, exclude the top five names (FAMAA) and the remaining 495 stocks are down 11%! FAMAA as a group is up 32% this year. Investors without these five names in their portfolios most likely have severely underperformed the market. This phenomenon continues throughout the capitalization spectrum. Take a look at Table 1 below –

The table clearly shows the effect of passive investing on the market. The highly weighted names (Top 10) are up almost 10% while the bottom decile is down almost 40%. In fact the returns are well correlated with size decile. As flows get invested in the larger names valuations get pushed up as seen from the various metrics – Price/Earnings (P/E), Price/Sales, Price/Free Cash Flow (P/FCF) and Price/Book. All these metrics show a similar trend – the top capitalization deciles are more expensive than the bottom ones. Our investment sweet spot is usually in the range of $5 Billion to $50 Billion in capitalization. The median market cap of the Alamar portfolio at the end of June was $13.5 Billion, the 7th decile of Table 1. Despite falling in the higher decile and not holding any of the FAMAA stocks, we have comfortably beaten the market so far this year.

Looking forward, we expect the investment landscape to change considerably as we work through the after effects of this crisis. Industries such as hotels, retail stores, large office buildings, dense apartment complexes, restaurants and more will be severely impacted. Financial institutions with large exposures to these industries will also be under scrutiny. As discussed, the dramatic difference in health outcomes of the poor and minorities in particular will most likely engender a societal response. We are already seeing the initial steps being taken. Health care and delivery will be under scrutiny. The CDC and the FDA were caught unprepared when the virus arrived. Personal Protective Equipment (PPE) was unavailable and lack of testing capabilities handicapped an effective response. We expect government at all levels to invest in healthcare infrastructure to avoid a recurrence. As in prior crises and recoveries, we expect investment opportunities to arise and we will be on the lookout for well managed companies at reasonable valuations.

CONCLUDING THOUGHTS

This year will be remembered for generations. A worldwide pandemic caught us severely unprepared. The lack of investment in healthcare infrastructure, inadequate information systems and poor, confusing leadership resulted in a chaotic response. While we are still attempting to comprehend the outbreak, other countries have already brought the disease under control.

The stock market, on the surface, seems disconnected from the damage to the real economy. However, a look under the hood shows wide disparities. A few popular names are driving all the returns while the vast majority of stocks are falling behind. As in the past, great investment opportunities present themselves during times of crises, and we are on the lookout to invest in them.

Thank you for your continued trust and confidence in Alamar Capital Management.

Sincerely,

George Tharakan, CFA

george@alamarcapital.com

Disclosures

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss.

This publication is made available for informational purposes only and should not be used for any other purpose. In particular, this report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.

i Wang Xiaowen, Bhatt D, et al. Association Between Universal Masking in a Health Care System and SARS-CoV-2 Positivity Among Health Care Workers. JAMA April 2020

ii Wadman Meredith, Matacic C, et al. Rampage through the Body. Science April 2020 VOL 368 ISSUE 6489

iii Maurizio Cecconi MD, Giacomo Grasselli MD, et al. Baseline Characteristics and Outcomes of 1591 Patients Infected With SARS-CoV-2 Admitted to ICUs of the Lombardy Region, Italy. JAMA April 2020

iv Integrated surveillance of COVID-19 in Italy. Department of Infectious Diseases Govt of Italy https://www.ecdc.europa.eu/en/publications-data

v Jonathan M. Wortham, MD et al. Characteristics of Persons Who Died with COVID-19 — United States. CDC MMWR July 10, 2020

vi Katie J Doores et al. Longitudinal evaluation and decline of antibody responses in SARS-CoV-2 infection. medRxiv preprint July 11, 2020

ACM Commentary 1Q 2020

MARKET COMMENTARY