ACM Commentary 3Q 2019

MARKET COMMENTARY

Despite plenty of headline risk and relative uncertainty, the market and asset classes of all kinds continued their upward march in 2019. The chart below depicts the performance of various asset classes across the risk spectrum through October of this year.

Figure 1: Market Year to Date Returns Through October

If you threw a dart at risk, you made money so far this year, but of course, charts like this make it all seem far too easy. As the saying goes, markets climb walls of worry, and there has been plenty of fodder for consternation in recent months. It seems though that much has been offset by a falling interest rate environment which has proven favorable for both equity and fixed income markets.

Of big concern for investors has been the escalating trade war between the two largest economies in the world, the U.S. and China. Additionally, we currently have an unconventional U.S. president who is openly critical of the Federal Reserve (Fed) while in the midst of impeachment proceedings. Add to this, growing populist movements, changes in governments in the UK and Italy, unrest in Hong Kong, as well as perpetual uncertainty around Brexit, and the picture grows even more cloudy.

And yet the market continues its rise to all time highs, erasing the losses of 2018 (A year in which every asset class save for cash lost money). This type of market near year end can strikes fear in the hearts and minds of cash heavy individual investors and underperforming professional investors alike, as both grow hungry to participate in the market’s gains. These investors might have a newfound appreciation for risk taking and a newfound willingness to overlook additional market uncertainty – a slowing global back drop chief among them (Figure 2).

Figure 2: Global Growth Forecasts

The Chart above shows the recent and forecasted global growth rates and is provided by the World Bank. Though the ultimate outcome for the global economy remains to be seen, what is growing increasingly clear is that despite their best efforts and massive monetary and fiscal stimulus, the Fed and the European Central Bank (ECB) have not been able to generate much in the way of meaningful sustainable growth. The only real quantifiable beneficiary of central bank policy has been risk-assets. For their part, sovereign debt levels now reside at unprecedented levels and due to anemic inflation and low growth, rates remain near all time lows. In fact, as of today roughly 25% or $17 Trillion of all government debt now trades at negative real rates of return! In many respects, we now live in a world that resides outside of prevailing economic theory that which has been taught in textbooks. Regardless, it is hard to debate that the current very low interest rate environment supports higher market valuations.

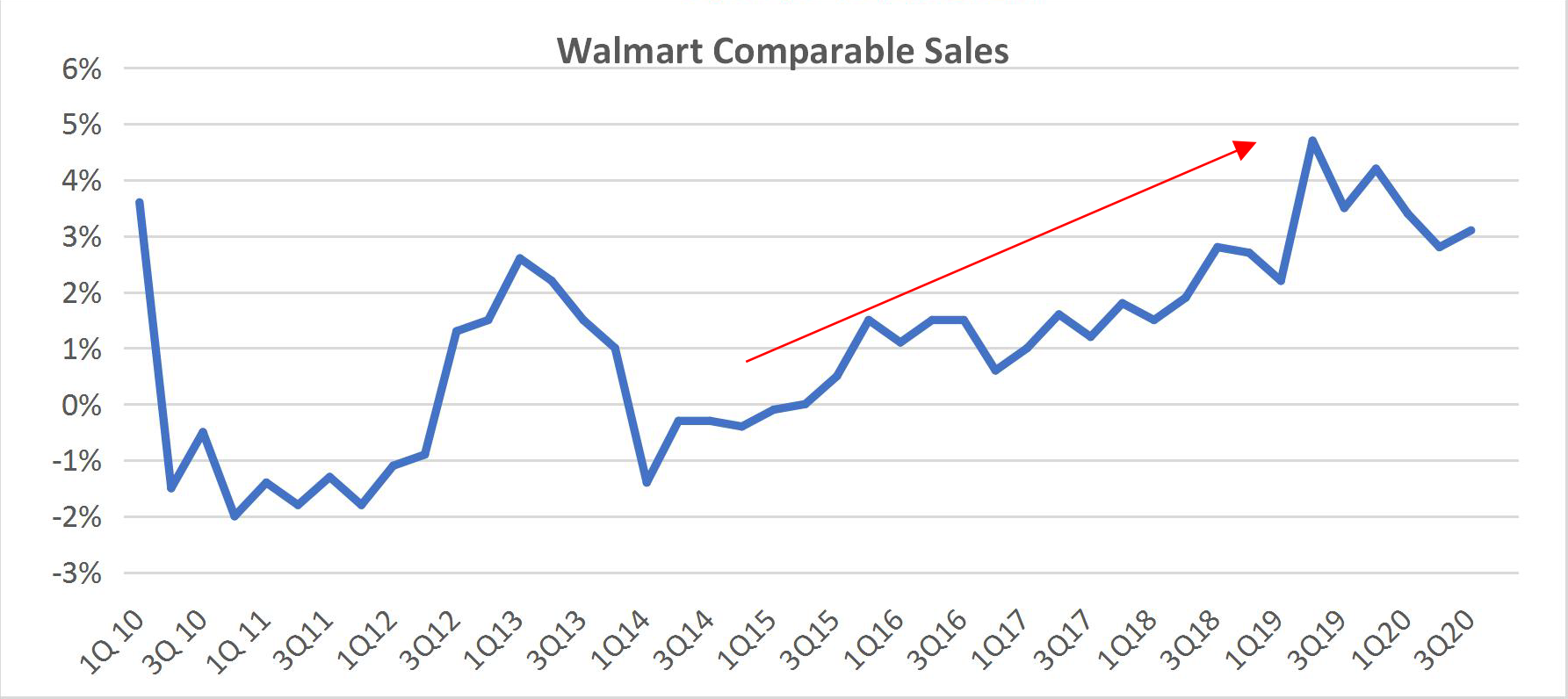

An additional bright spot has been the resiliency of the U.S. consumer. Despite slowing manufacturing activity, and reduced capital expenditures by corporate CEO’s consumer confidence remains high, the labor market remains tight and is now beginning to see some wage growth. The chart below shows the comparable quarterly sales growth, or same store sales from Walmart (WMT). As the largest retailer in the world Walmart provides a very useful barometer for the health of the consumer.

Figure 3: Walmart Same Store Sales

For Walmart, comparable store sales include sales from stores and clubs open for the previous 12 months, including remodels, relocations and expansions. Contrary to the global backdrop, this is an encouraging sign, and it is not unique to just Walmart. Costco (COST) shares recently reached an all-time high due to growing sales. Their comparable sales in the U.S. for the month of October came in at 5.0%, providing further evidence to the strength of the U.S. consumer.

SUMMARY

As is almost always the case, there is plenty for investors to worry about. This year they had to overcome uncertainty and continue to allocate towards risk but have been rewarded so and for that matter, over the past decade. Despite earnings results that have come in far below expectations, the market has exceeded expectations, due in large part, to low rates and accommodative Fed policy. This low interest rate environment seems to support the market at these levels, but there are headwinds, namely slowing global growth and a heavy debt burden. Despite trade risk and slowing manufacturing activity and expenditures amongst corporations, the U.S. consumer remains a real bright spot and with consumer spending representing almost 70% of the overall U.S. economy this is a noteworthy positive.

As for Alamar, we know that investing is a long-term activity. We believe thoughtful exposure to risk that reflects each of our individual risk profiles is the best approach to meeting our long-term goals over time. This approach enables us to stay the course during inevitable disruptions and leaves us pleasantly surprised when our expectations are exceeded.

Thank you for your time and continued consideration –

John Murphy, CFA

DISCLOSURES

The views expressed in this note are as of the date initially published and are subject to change without notice. Alamar has no obligation or duty to update the information contained in this note. Past performance is not an indication of future results. Risk is inherent in investments and involves the possibility of loss. Net of fee performance is calculated using the highest fee. The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The S&P 500 Index, which is a market-capitalization weighted index containing the 500 most widely held companies chosen with respect to market size, liquidity, and industry.

This publication is made available for informational purposes only and should not be used for any other purpose. This report should not be construed as a solicitation of an offer to buy or sell any security. Information contained herein was obtained and derived from independent third-party sources. Alamar Capital Management, LLC believes the sources are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information.

This publication, and the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form or media without the prior written consent of Alamar Capital.